Schaffhausen - area for makers: a location featuring a diverse mix of business sectors, with a strong manufacturing base, international headquarters, and unique quality of life.

Schaffhausen is a preferred business, innovation, and residential location. Our proactive and targeted location strategy attracts dynamic people and companies to Schaffhausen to create something new. Here, entrepreneurs and international companies meet deep manufacturing expertise and people with a strong "maker mentality". Companies in Schaffhausen benefit from our immediate proximity to the economic region of Zurich with its international airport and first-class universities. Highly-skilled specialist staff from southern Germany, just across the border, expand access to an excellent talent pool. A particular advantage of our business location is the ease of access - be it to business, research, politics & government, or authorities.

The attractive cost environment also leaves companies and families with more to invest. Schaffhausen radiates familiarity, where people put down roots and feel secure. A region worth living in!

Find out more about Schaffhausen - area for makers

Ecosystem

- Predominant industries

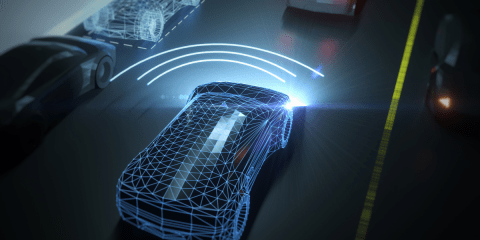

Pharma & Life Sciences, Packaging industry, Plastics & Injection molding, Automotive & Smart mobility, Food industry/ Food-Tech - Flagship companies

Janssen/J&J, Georg Fischer, Unilever, Syntegon Packaging, AGCO, Xylem, AbbVie/Pharmacyclics - Recent additions

Ascent Health, Pronatec

Links

- Why Schaffhausen

- Success Stories

- Calculator individual taxes (only in German available)

- Tax calculator legal entities (only in German available)

More public partners

More public partners

The Greater Zurich Area Foundation and the operational Greater Zurich Area Ltd. (GZA) are supported by 11 public partners. This anchors the organization in the regional business spheres within the economic area from which settling companies benefit.

Contact us

Can we put you in touch with a peer company or research institute? Do you need any information regarding your strategic expansion to Switzerland's technology and business center?

info@greaterzuricharea.com