The Canton of Zurich - Economic Centre of Switzerland

The Canton of Zurich is home to a dynamic hub of companies, research and educational institutions, specialist organisations, public sector organisations and creative minds. The more than 116,000 companies in the canton form an active network of big international corporations, innovative medium-sized firms and highly specialised small businesses. With an annual GDP of over 150 billion Swiss francs –which is more than twenty per cent of the national GDP– Zurich achieves the largest economic performance and value creation in Switzerland.

With outstanding higher education institutions, including ETH Zurich, the University of Zurich and other universities on their doorstep, companies can draw on an impressive talent pool. This is one of the reasons why large companies like Google, IBM, Microsoft, Meta and AWS have chosen to set up in Zurich.

In addition to vibrant cities with a wide array of cultural attractions, a dense public transport network and Switzerland’s largest airport, the Canton of Zurich also features a balanced blend of innovative industries. Zurich’s largest key industry is the finance sector, followed by ICT, Life Sciences und Cleantech ― as well as High Tech und Food as emerging ecosystems that encompass a myriad of innovative companies and university spin-offs.

There are several innovation hubs in the Canton of Zurich where companies can share ideas with start-ups and where science and industry can draw inspiration from each other, including Switzerland Innovation Park Zurich, Bio-Technopark Schlieren-Zurich, Digital Health Center Bülach, Trust Square and Healthtechpark Zürich-Schlieren. An overview of innovative companies, organisations and innovation hubs, as well as news and events on innovation in the Canton of Zurich is provided on the Innovation Zurich website.

The Division of Business and Economic Development of the Canton of Zurich is your point of contact for advice on questions related to business activities, for guidance on choice of location, for establishing a company and for networking within the local ecosystem.

Ecosystem

- Most important industries

Banking and Finance, Insurance, Information and Communication Technology, Life Sciences (esp. Biotech and Medtech), Cleantech, High Tech - Flagship companies

- UBS, Credit Suisse, Zurich, Swiss Re, IBM Research, Google, Microsoft, Climeworks, Agile Wind Power AG, HeiQ, Kyburz, Sonova, Zimmer Biomet, Tecan, Autoneum

- Companies that have recently set up in Zurich

Facebook (Meta), Oracle Labs, Benchling, Takeda, MSD, Vetements, ICBC, Magic Leap, Hyundai Electric, Matternet, Amazon Web Services (AWS), Hitachi Energy - Zurich unicorns

WayRay, On Running, Sensirion, Scandit, Climeworks, South Pole, GetYourGuide, wefox, Dfinity, Leonteq, avaloq

Links

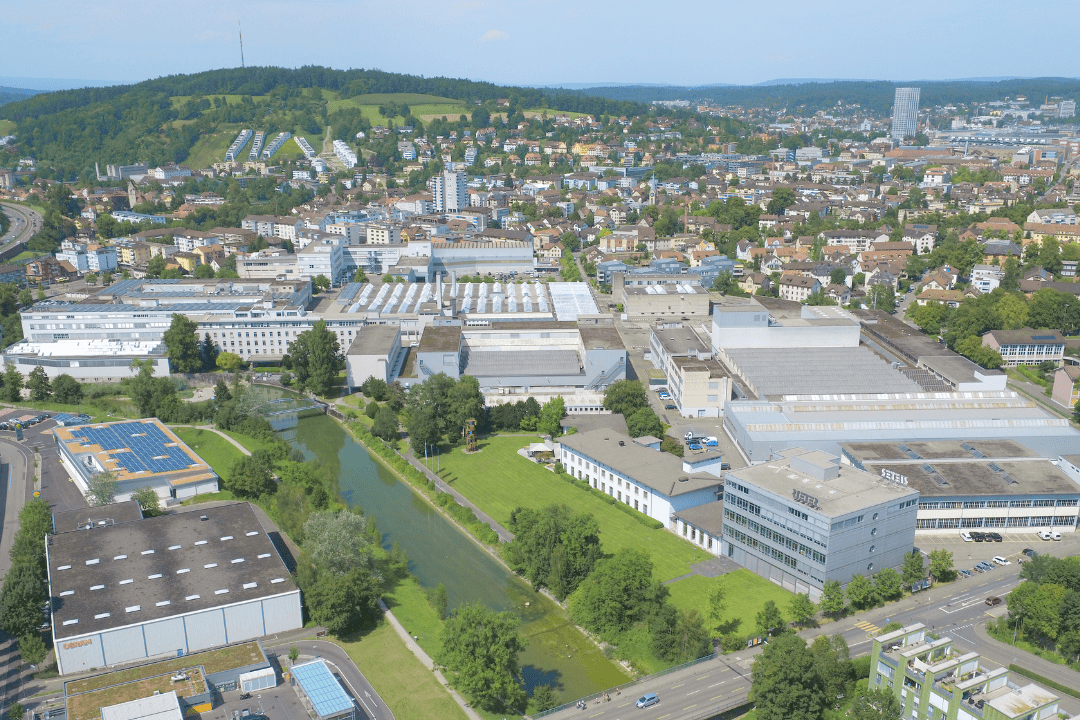

Industrial Site Rieter Areal: Well connected

Industrial Site Rieter Areal: Well connected

2 acres (800m2) of manufacturing/ warehouse space just 20 minutes from Zurich Airport.

More public partners

More public partners

The Greater Zurich Area Foundation and the operational Greater Zurich Area Ltd. (GZA) are supported by 11 public partners. This anchors the organization in the regional business spheres within the economic area from which settling companies benefit.

Contact us

Can we put you in touch with a peer company or research institute? Do you need any information regarding your strategic expansion to Switzerland's technology and business center?

info@greaterzuricharea.com