Experience gained from world-leading corporations shows that high-tech companies from all over the world find excellent conditions for settlement and growth in the Grisons. Highly educated professionals discover challenging jobs and a high quality of life in Switzerland's most popular vacation region. Production and innovation-oriented companies benefit in the trilingual canton from first-class traffic links, modern education, and research centers, advantageous cost structures, a moderate tax climate, and business-friendly politics that put great emphasis on promoting innovation.

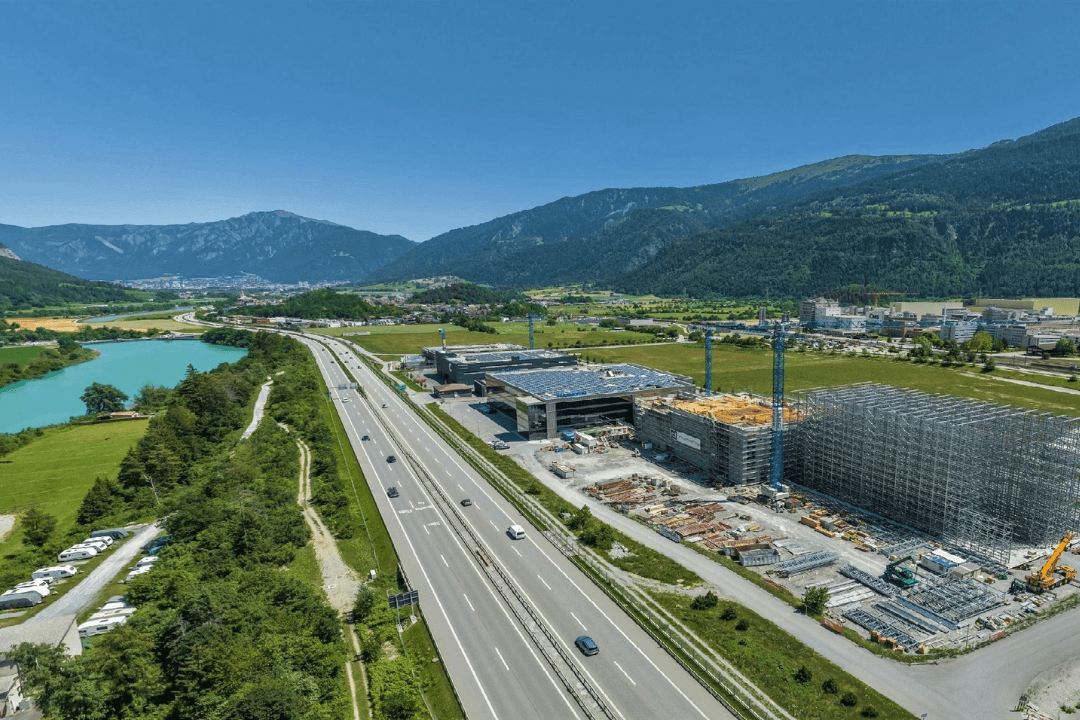

Excellently developed industrial sites for export and production-oriented companies are becoming rare in Switzerland. Except in the Grisons: Switzerland's largest canton has more than 300,000 square meters of land in perfectly developed industrial zones on the main north-south transit axis with direct connections to the metropolitan areas of Munich/Stuttgart, Zurich/Basel, Innsbruck and Milan/Turin.

Quality of life is becoming a decisive criterion when choosing a job. This plays into the hands of the Grisons as a business location. The Grisons offers qualified professionals the whole package: families can enjoy excellent educational opportunities and a wide range of leisure activities for children and adults. Companies can count on the excellent quality of life in the Grisons when recruiting staff.

The Grisons offers innovative companies federal and cantonal funding schemes. These include financial contributions, loans, guarantees or tax relief. The Grisons is open to new ideas and welcomes start-ups. Transfer of knowhow and access to the global talent pool are ensured by the presence of universities and universities of applied sciences, incubators, internationally established research institutions and export-oriented local companies.

Ecosystem

- The most important industries

Life science, Medtech, chemicals, mechanical engineering, automation, sensor technology, photonics, ICT - Flagship companies

Hamilton Group, INTEGRA Biosciences, ACS Dobfar, Baxter Group, EMS-Group, TRUMPF, Wittenstein Group, CEDES, Viega, Inventx - Recent settlements

Hamilton-Ems, Speed U Up, poweersnet

Links

Fertile soil for high-tech companies

Fertile soil for high-tech companies

Large, excellently developed industrial land at attractive conditions provides companies with room for settlement and growth.

More public partners

More public partners

The Greater Zurich Area Foundation and the operational Greater Zurich Area Ltd. (GZA) are supported by 11 public partners. This anchors the organization in the regional business spheres within the economic area from which settling companies benefit.

Contact us

Can we put you in touch with a peer company or research institute? Do you need any information regarding your strategic expansion to Switzerland's technology and business center?

info@greaterzuricharea.com